Payroll Service Costs for 2025: How Much Should You Pay Monthly? (Updated May 17, 2025)

In 2025 online payroll services cost at least $39 a month plus an additional cost per user, totaling between $5 to $25 per employee, however, larger employers will see a lower per-employee cost.

Use the guide below to check out popular payroll brands, or to check out specials and free trials from top rated payroll service providers.

Leading Payroll Service Providers

ADP Payroll Services

- Largest US Payroll Brand

- Payroll & HR Solutions

- Scalability and Flexibility

Paycor Payroll Solutions

- Comprehensive HR and Payroll Integration

- Easy to Customize and Scale

- Pay employees from remotely

Insperity Payroll Services

- Comprehensive Payroll Service

- World Class Customer Support

- Easy Integration

OnPay Payroll Cost & Features

- Ease of Use

- Excellent Service at a Competitive Price

- $0 Setup & Data Migration

Gusto Payroll Pricing & Benefits

- Best For Small Businesses

- User-Friendly Interface

- Simple DIY Setup

Paychex Payroll Outsourcing Cost

- Robust Services

- Scalability and Customization

- Dedicated Payroll Specialists

What Are the Benefits of Using a Payroll Service?

A payroll service benefits businesses by managing payroll administration expenses, improving accuracy, and keeping tax requirements in check.

Outsourcing payroll tasks saves time and resources that lengthy payroll duties consume, while providing access to expert help.

Payroll service providers stay updated with changing payroll rules, minimize risks, and make sure employee payments are processed correctly. For those interested in a comprehensive overview, our deep dive into the Top 10 Payroll Services of 2023 offers valuable insights into the best options available.

1. Saves Time and Resources

One of the primary benefits of using payroll services is that it saves time and resources, enabling you to focus on core business activities instead of getting caught up in payroll processing.

Automatic systems for time tracking help accurately log employee hours, making sure all time worked is recorded correctly.

Service providers are important in minimizing human errors, making work processes smoother and decreasing the risk of compliance issues.

Using these advanced payroll solutions helps businesses run more smoothly and allows them to spend more time on growth plans.

2. Reduces Errors and Compliance Risks

This proactive method maintains tax compliance and protects companies from large fines that accidental errors or missed details can cause.

By using professional payroll services, businesses can benefit from specialists who know the current regulations, reducing the risk of mistakes.

These services employ advanced technology to monitor any updates in tax laws, ensuring that all wages are calculated correctly and timely, minimizing the risk of audits. Payroll audits are a key step that lets organizations regularly check their payroll procedures to make sure they follow federal and state laws.

3. Provides Expertise and Support

Regular discussions and the use of expert knowledge help companies simplify payroll tasks, ensuring compliance and accuracy while supporting a smoother management process.

These providers usually have various resources, including customer support teams who can help with immediate questions and handle payroll issues as they come up.

This means that businesses can handle complicated payroll systems confidently, which lowers the need to spend money on payroll experts.

Many payroll service providers have training programs that give clients the skills needed to handle payroll well. By frequently talking about and applying specialist knowledge, companies can simplify their payroll tasks, ensuring compliance and accuracy, while promoting easier management.

SUMMARY:

| Benefit | Description |

|---|---|

| Saves Time and Resources | – Reduces time spent on manual payroll tasks – Enables focus on core business operations – Automates time tracking for accurate logging – Minimizes human error and streamlines processes |

| Reduces Errors and Compliance Risks | – Helps maintain tax compliance and avoid penalties – Ensures accurate wage calculation and timely payments – Monitors changes in payroll and tax laws – Supports regular payroll audits |

| Provides Expertise and Support | – Offers access to payroll specialists – Includes customer support for real-time problem solving – Reduces need for in-house payroll staff – Often includes training programs for internal teams |

What Are the Different Types of Payroll Services?

Payroll services offer various types to meet different business needs and preferences.

Knowing these choices helps you pick the best payroll solution for your company.

Full-service payroll manages all payroll tasks, including tax filing and compliance, while online payroll offers a hands-on approach with budget-friendly software.

Self-service payroll lets employees access their records and handle simple tasks like tracking their hours. Payroll outsourcing gives businesses flexibility and access to payroll professionals. For a detailed comparison of the top payroll services available, check out our Top 10 Payroll Services of 2023.

1. Full-Service Payroll

Full-service payroll provides an all-in-one solution that manages all aspects of payroll, ensuring compliance with labor laws and maintaining payroll accuracy.

This service includes automatic payroll systems that simplify payment tasks, saving time and reducing common mistakes in manual entries.

Business owners receive help with tax compliance, addressing the details of tax calculations and tracking deadlines to minimize the risk of expensive fines.

Payroll reporting features provide useful data, enabling owners to make well-informed financial choices and feel secure.

These advanced capabilities alleviate the overwhelming burden of payroll management, allowing business owners to focus on their core operations and growth strategies.

2. Online Payroll

Online payroll services provide businesses the flexibility to manage payroll through web-based software, often at competitive payroll software pricing.

These platforms enable employers to access payroll data anytime, anywhere, thanks to mobile payroll apps that facilitate on-the-go management.

Users can easily link these services to their existing systems, resulting in a smooth and hassle-free transition compared to common payroll processing problems.

The user-friendly design enables people without much accounting experience to use the software easily.

Real-time payroll updates improve the accuracy of financial reports, giving businesses immediate details about their payroll costs and allowing quick changes when necessary.

This ease of use allows companies to handle their financial duties easily.

3. Self-Service Payroll

Self-service payroll enables employees to view their payroll details through special online sites.

Workers can handle payroll deductions and view their pay slips at any time.

This new approach increases transparency and prompts staff to take ownership. When employees have the tools to manage their own finances, businesses create a more involved workforce.

These employee self-service portals make payroll jobs easier, cut down on paperwork, and lower errors, leading to more accurate pay handling. When employees access their payroll details, they experience greater job satisfaction, leading to higher retention and a better work atmosphere.

Giving employees more responsibility boosts their confidence and strengthens their trust in management.

4. Tax Filing Services

Tax filing services play a critical role in payroll services. These services make sure payroll taxes are accurately calculated and filed according to tax laws.

Using these services allows businesses to cut compliance costs significantly, freeing them from the often-changing and complicated tax codes.

Incorrectly filing taxes can lead to significant fines and penalties, burdening finances and interrupting business activities.

Relying on professionals for tax services alleviates the stress of meeting deadlines and allows companies to focus on their core activities.

These services guarantee correct payroll and strengthen trust with employees and stakeholders by managing taxes properly.

Compare Payroll Service Costs by Top Providers

Let’s take a look at popular payroll service providers along with their current publish costs.

ADP Payroll Pricing

COST: 3 Months Free

ADP Payroll is an industry stalwart, renowned for its reliable payroll processing and extensive HR functionalities. Serving businesses from small to enterprise-level, its system is robust, offering tax compliance, detailed reporting, and seamless integrations. While its comprehensive features cater to a broad audience, some users might find the platform slightly overwhelming initially. Yet, with solid customer support and continuous updates, ADP remains a trusted choice in the ever-evolving payroll landscape. Learn more here.

COMPARE PLANSOnPay Payroll Cost Breakdown

COST: $40/month + $6 per person

OnPay Payroll shines with its simplicity and efficiency, making it a favorite among small to medium-sized businesses. The platform’s clear interface and straightforward processes enable effortless payroll runs, tax filings, and benefits management. Its transparent pricing and stellar customer support further enhance the user experience. While it may lack some of the advanced features of larger competitors, OnPay’s focus on core functionalities ensures a hassle-free payroll experience for its users. Learn More

COMPARE PLANSRippling Payroll Service Fees

COST: Starts at $39/month + $8 PEPM

Rippling offers an intuitive payroll solution streamlined for businesses of all sizes. Its user-friendly interface and seamless integrations make payroll processing a breeze, ensuring timely and accurate payments. Features like automatic tax filing, benefits syncing, and real-time reporting enhance its robustness. However, as with any software, occasional hiccups may arise. Overall, Rippling payroll effectively blends efficiency with simplicity, making it a top contender in the payroll software market. Learn More

COMPARE PLANSPaychex Payroll Pricing Plans

Cost: $39/Month + $5 per employee

Paychex, Inc., established in 1971 and headquartered in Rochester, New York, provides payroll, human resource, and benefits outsourcing solutions for small to medium-sized businesses in the United States and Europe. Renowned for its payroll services, the company handles employee payment, taxation, and compliance issues, facilitating smoother business operations. Paychex also offers HR solutions, including employee handbook creation, training, and assistance with compliance matters. Additionally, they supply benefits administration, including retirement planning and insurance services. Paychex emphasizes technology, offering cloud-based solutions and user-friendly apps to streamline processes like payroll management, benefits administration, and HR functions, contributing to its well-regarded status in the industry. Learn More

COMPARE PLANSGusto Payroll Outsourcing Cost

Gusto Payroll Cost:

The below are the cost of payroll services currently published on this company’s website.

- Simple: $40/Month plus $6 per person

- Plus: $80/Month plus $12 per person

Gusto, founded in 2011 and headquartered in San Francisco, California, is a cloud-based platform providing payroll, benefits, and human resources management solutions targeted predominantly at small businesses in the United States. The platform is designed to simplify complex business processes such as payroll processing, tax filing, and employee benefit management, making them accessible and manageable for business owners. Gusto is recognized for its user-friendly interface, automated functionalities, and customer-centered approach, particularly aiding companies without dedicated HR departments. The platform also emphasizes its commitment to ensuring regulatory compliance, providing tools and resources to help businesses adhere to local, state, and federal labor laws. Learn More

COMPARE PLANSQuickBooks / Intuit Payroll Services Cost

Quickbooks Payroll Cost:

The below are the cost of payroll services currently published on this company’s website.

- Simple Start: $15/month

- Essentials: $30/month

- Plus: $45/month

- Advanced: $100/month

QuickBooks, developed by Intuit Inc., is a comprehensive, cloud-based financial management software aimed at small and medium-sized businesses, offering features like expense tracking, invoice generation, and robust reporting. Intuit Payroll, often used in conjunction with QuickBooks, provides payroll services and solutions, catering to the varied needs of businesses, including automated payroll, tax filing, and employee payment management. With its user-friendly interface and integration capabilities, it ensures that payroll taxes and employee payments are processed efficiently and accurately. QuickBooks and Intuit Payroll prioritize simplifying financial and payroll management for businesses, enabling them to focus on core operational activities while ensuring regulatory compliance and financial accuracy. Learn More

COMPARE PLANSBambee Payroll Outsourcing Pricing

Cost: $99/month – No set up fee

Bambee offers a tailored approach to payroll and HR management, catering especially to small and medium-sized businesses. The platform pairs companies with dedicated HR managers, ensuring compliance and streamlining HR tasks. Its affordable pricing model makes professional HR services accessible even for startups. While Bambee’s specialty lies in compliance and policy guidance, some users may desire broader functionality. Overall, Bambee delivers value by demystifying HR and simplifying complex compliance landscapes.

COMPARE PLANSPaycor Payroll Cost Analysis

Cost: $99/month + $5 per employee

Paycor provides a comprehensive HR and payroll solution suited for businesses of varying sizes. Its platform boasts an intuitive interface, making tasks like payroll processing, time tracking, and benefits administration straightforward. Key features like robust reporting and mobile accessibility stand out. While most users appreciate its functionality, some have mentioned occasional software updates can be disruptive. Overall, Paycor strikes a balance between depth and user-friendliness, making it a solid choice in the HR software arena.

COMPARE PLANSSurePayroll Service Cost

Cost:

The below are the cost of payroll services currently published on this company’s website..

- Accounting Software Integration: $4.99/month

- Local Tax Filing: $9.99/Month

- Stratustime integrated timeclock: $5/mo. + $3/EE/mo.

SurePayroll, a Paychex company, delivers cloud-based payroll and HR solutions, predominantly catering to small businesses, households, and accountants. Founded in 2000 and headquartered in Glenview, Illinois, SurePayroll emphasizes simplicity and convenience, offering online payroll services that manage wage payments, tax filings, and compliance with federal and state regulations. Renowned for its 24/7 support and user-friendly platform, SurePayroll enables users to run payroll on various devices, ensuring flexibility and accessibility. Additionally, it provides direct deposit and online filing options, seeking to streamline payroll processing and enhance accuracy. With various features aimed at minimizing the payroll management burden, SurePayroll positions itself as a dependable, intuitive payroll service provider.

COMPARE PLANSWhat Factors Affect the Cost of a Payroll Service?

Various elements impact the price of payroll services, affecting total expenses for payroll processing charges and the overall budget for these services.

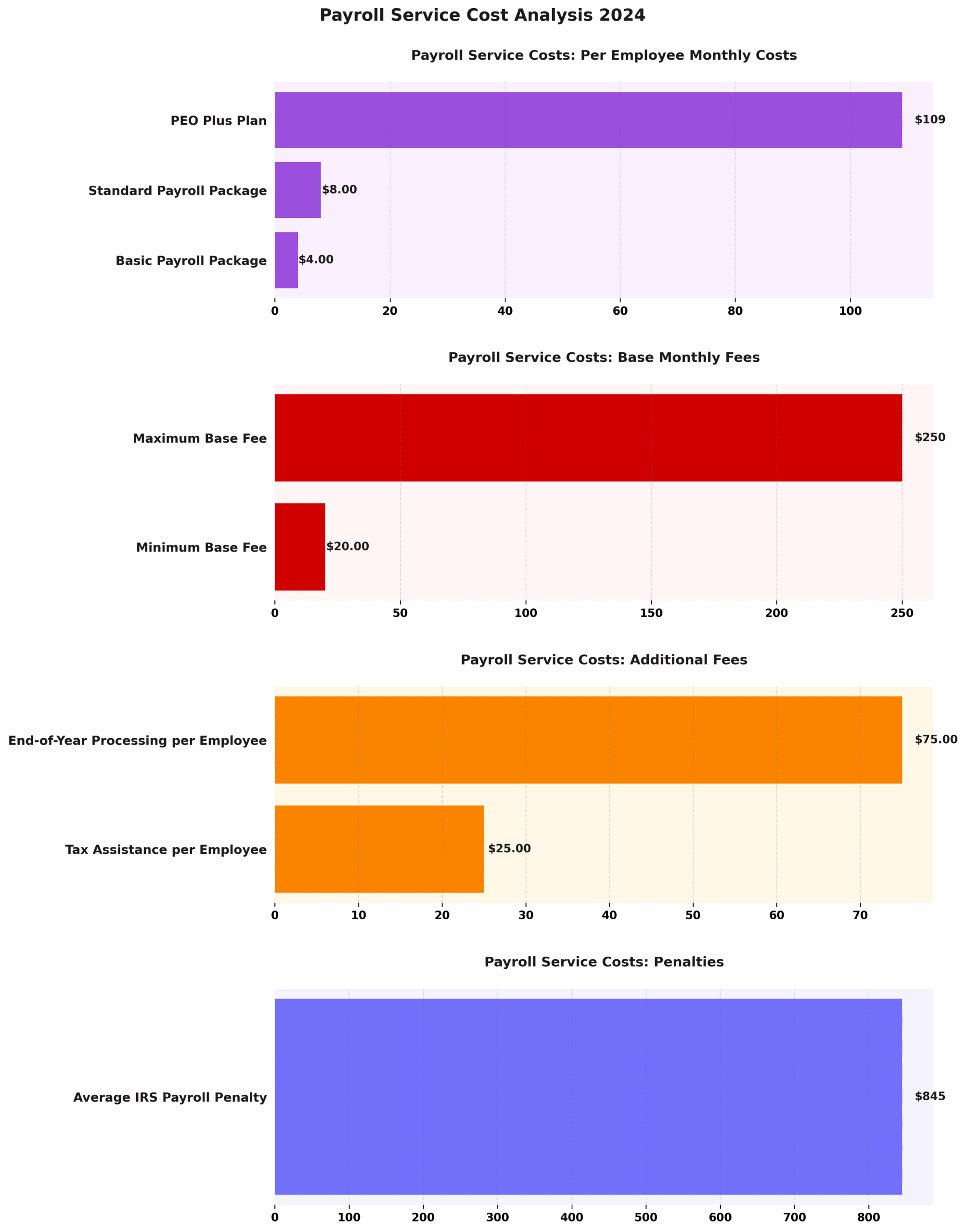

Payroll Service Cost Analysis

The Payroll Service Cost Analysis 2024 gives a detailed analysis of costs related to payroll services and helps businesses select the best plan according to their size and requirements. Knowing the parts that make up costs can help manage payroll better and reduce expenses. For those curious about how different payroll services and their features affect these costs, you might find our guide to different types and features insightful.

Payroll Service Costs detail various packages and additional fees.

- Per Employee Monthly Costs: Three primary packages present varied service levels. The Basic Payroll Package at $4.00 per employee handles basic payroll tasks and is suitable for small businesses with simple requirements. The Standard Payroll Package, priced at $8.00 per employee, offers more detailed features and is perfect for businesses requiring detailed tracking and reporting. The PEO Plus Plan at $109.00 per employee provides top-notch services, often including broad HR and compliance assistance, attractive to bigger businesses looking for combined solutions.

- Base Monthly Fees: These range from a minimum of $20.00 to a maximum of $250.00, reflecting cost variability based on the complexity and scale of services offered. Businesses need to evaluate their specific requirements to select an appropriate base package.

The Additional Fees section outlines extra costs that may apply:

- Tax Assistance per Employee at $25.00 helps meet tax rules and lowers the chance of mistakes and fines.

- End-of-Year Processing per Employee costs $75.00 and includes year-end paperwork and reporting, which are important for keeping correct financial records and meeting legal requirements.

Consider penalties, as the Average IRS Payroll Penalty of $845.00 deters non-compliance.

The Payroll Service Cost Analysis 2024 shows how payroll expenses work and highlights the need for businesses to find a balance between cost and service quality.

1. Number of Employees

The number of employees significantly influences your payroll service costs, as many providers charge a per-employee fee.

When a small business grows, hiring more employees raises payroll costs.

This may lead owners to reconsider their budgeting and payroll strategies.

To address this, business owners should look into various payroll choices, like using software that includes services or setting fixed fees to handle changes in employee numbers.

Hiring outside help for payroll simplifies operations and potentially reduces costs as more people join the team, which becomes important when the business grows.

2. Frequency of Payroll Processing

The frequency of payroll processing-whether weekly, bi-weekly, or monthly-also affects your overall payroll service costs.

Paying employees every week allows them to get their money sooner, which can improve their mood and help them manage their finances more effectively.

But picking bi-weekly or monthly options makes tasks easier, cuts costs, and reduces mistakes common with manual work.

Manual payroll calculations often lead to mistakes, resulting in incorrect paychecks and compliance issues, which further complicate payroll tasks and harm employee satisfaction.

3. Additional Services and Features

Choosing to include additional services and features in your payroll package leads to varying payroll service costs and potential hidden payroll costs.

For example, combining employee benefits tasks simplifies handling health insurance, retirement plans, and other perks, ensuring your team receives the right support without extra effort.

Checking payroll often helps spot mistakes, follow legal rules, and avoid fines or corrections later.

Adding tax filing services to your payroll system helps you submit on time and lowers the chance of tax penalties, offering reassurance.

Choosing these extra services enables businesses to run their operations more smoothly and improves how they handle payroll.

COMPARE PLANS

Pros and Cons of Payroll Outsourcing

| Advantages | Disadvantages |

|---|---|

| Cost savings: Eliminates the need for in-house payroll staff, software, and resources, which can reduce costs, especially for small to medium-sized businesses. | Loss of control: Businesses relinquish some control over payroll processes, which can raise concerns about data security, privacy, or service quality. |

| Time savings: Frees up time for business owners and HR staff by removing the time-consuming task of payroll processing. | Dependency on a third party: Businesses become reliant on the service provider, which may pose risks if the provider encounters issues. |

| Expertise and compliance: Payroll providers ensure compliance with payroll taxes, regulations, and prevent costly mistakes or penalties. | Hidden costs: There may be setup fees, additional charges, or fees for changes that can make outsourcing less cost-effective than it appears. |

| Access to technology: Providers use advanced software for accurate, efficient, and secure payroll processing. | Data security and privacy risks: Sharing sensitive employee data with a third party may lead to security and privacy concerns. |

| Scalability: Easier to scale operations with flexible adjustments to payroll as businesses grow. | Limited customization: Providers may lack flexibility to meet unique payroll requirements, leading to potential mismatches with business needs. |

Payroll Service Fee Types

Knowing the cost of a payroll service is important for managing finances.

Various pricing options meet the needs of different businesses. For a detailed analysis of current costs, our guide on payroll service costs in 2025 offers valuable insights.

Various pricing options meet the needs of different businesses. For a detailed analysis of current costs, our guide on payroll service costs in 2025 offers valuable insights.

1. Flat Monthly Fee

A flat monthly fee serves as a simple pricing model for many payroll services, allowing businesses to know their payroll service costs in advance.

This model simplifies budget planning and allows companies to allocate funds more effectively without the uncertainties that come with fluctuating prices.

Knowing exactly what to expect each month helps businesses avoid the stress of unexpected expenses that may arise with hourly rates or transaction-based pricing structures.

Unlike pay-per-use services that result in high costs depending on transaction volume, a flat fee model usually includes many payroll services, such as tax filings, benefits handling, and compliance management.

This approach provides clients with a complete package for their financial planning needs.

This openness smoothens operations and builds trust between the business and its payroll provider.

2. Per Employee Fee

A per-employee fee model charges businesses for each processed employee, allowing payroll services to scale as the workforce grows.

This approach particularly advantages small businesses that experience fluctuations in their workforce, such as seasonal hiring or project-based employment. These businesses adjust their payroll expenses according to the real count of employees, instead of sticking to a fixed fee that might not reflect their present staff size.

As the number of employees varies, the corresponding costs adjust accordingly, providing a flexible financial structure. This model helps save money when funds are limited, keeping payroll costs manageable and steady, which helps in operating the business effectively.

3. Additional Fees for Services and Features

Beyond standard pricing models, payroll services often include additional fees for specific services and features, which can impact your total payroll service costs.

Businesses should investigate these possible extra charges, as they can greatly impact the total budget.

For example, payroll audits often require specific skills, which can increase charges beyond the basic fee. Similarly, tax filing services might introduce costs related to the complexity of returns, especially for companies with multiple states involved.

Onboarding new employees often incurs extra expenses, covering costs for training and administrative handling.

Knowing these fees helps businesses choose payroll providers that match their budget and operation needs.

How to Choose the Right Payroll Service for Your Business?

Choosing the right payroll service for your business involves considering what you need, the features included, and the quality of customer reviews. As mentioned in our guide to different types and features of payroll services, understanding these aspects can help streamline your decision-making process.

1. Assess Your Business Needs

The first step in choosing a payroll service involves thoroughly assessing your business needs, which can help determine which payroll service features are essential for your operations.

This assessment should include evaluating factors such as employee classification, whether they are full-time, part-time, or contract workers, as each type may have different payroll requirements.

The number of employees influences the pricing and complexity of the payroll service you choose; some services are more equipped for larger organizations, while others cater to small businesses.

Knowing specific payroll processing needs-such as following local tax laws or working with your current HR software-will help you choose a solution that fits well with your practices and improves overall efficiency.

2. Research and Compare Providers

Carefully checking many payroll companies is important to choose the right one for your business.

This process involves examining each provider’s services, comparing payroll options, and reading customer feedback.

By carefully looking at and comparing these aspects, you can judge how dependable and effective various choices in the market are.

Knowing what each provider offers allows business owners to pick a payroll solution that suits their operations, makes processes smoother, and aligns with their objectives.

In the end, making an informed decision can simplify payroll processing and increase employee satisfaction.

3. Consider Customer Reviews and Reputation

Paying attention to the experiences shared by others helps individuals gauge how reliable these providers are in terms of service accuracy and responsiveness.

Customer feedback often highlights both the speed of handling payroll and the quality of help available when problems occur. This information can be very useful when considering different options, as it helps make a choice that fits particular business needs.

Choosing a reliable provider isn’t just about what they offer. It’s also about feeling secure, knowing help is available when needed.

4. Evaluate Cost and Features

When choosing a payroll service, compare the costs with the features provided to make sure you get good value for your money.

Tightly aligning pricing models with the essential features and services required for effective payroll management can seem challenging. Consider the basic features like handling payroll and following tax rules, and include features such as employee self-service portals and live reporting.

The significance of service contracts comes into play, as these agreements often determine the level of support and resources available, guiding businesses in selecting a service that meets their specific needs without incurring unnecessary expenses.

Thoroughly examining these aspects enables companies to make well-informed choices that improve their payroll methods and overall work efficiency.

5. Look for Integration Options

To choose a payroll service, evaluate how well it works with your accounting software, as this can simplify your financial tasks.

This reduces manual input mistakes and improves data accuracy, while also increasing overall efficiency.

This allows businesses to concentrate on their main activities instead of handling administrative work.

Different service providers offer a range of integration capabilities, with some providing advanced solutions that seamlessly connect payroll, HR, and accounting functions.

Since each choice differs, evaluate how these features match your specific business requirements. This helps you save time, cut expenses, and create more dependable financial reporting.

Each payroll provider starts with a monthly base rate. This is the cost for using the basic services. In order from least expensive to most expensive, the major payroll providers and their base rates are:

- Intuit (Quickbooks) – monthly cost starts at $50.

- Payficiency – monthly cost starts at $35.

- PayUSA – monthly cost starts at $35.

- Gusto (formerly ZenPayroll) – monthly cost starts at $39.

- Onpay Payroll – monthly cost starts at $40.

- Benefitmall – monthly cost starts at $57.

- MyPayroll– monthly cost starts at $63.

- IOI – monthly cost starts at $66.

- Complete Payroll Solutions – monthly cost starts at $69.

- SurePayroll – monthly cost starts at $80.

Compare Payroll Service Providers Near You and Save on Payroll Outsourcing

COMPARE PAYROLL COSTSRelated Services Available: Small Business, Direct Deposit, Taxes, Tax Filing, W-2, 1099, File, Employee, Workers Compensation

People Interested in Online Payroll Also Viewed:

Employee Retirement Plan Pricing

Related Information: IRS