QuickBooks Payroll Cost In 2023 | Compare Prices, Reviews, Products, Pro & Cons, Alternatives

QuickBooks is an easily navigated and affordable payroll software for many small businesses. Here’s what you need to know about using Quickbooks for company payroll.

Inquit QuickBooks Info:

Headquarters: Mountainview, CA

CEO: Sasan Goodarzi

Stock: INTU (NASDAQ)

# Employees: 200+

Choosing the right payroll system for a business can seem like a bear of a task at first. There are dozens of programs all offering various perks at different prices.

With every program, there are different levels of offerings and each of those offerings has discounts, various services, and an impact on your business.

We’d like to step in and help you find the answers about the Quickbooks Payroll cost and services they provide for those costs.

What is QuickBooks Payroll?

Quickbooks is a program sold by Intuit that helps a business maintain their paychecks, tax information, and worker’s compensation.

Simply put this program makes managing employees easier and businesses easier. Their goal is to save you time so that you can work on running your business, not crunching numbers.

It’s one of the most widely used programs on the market.

Quickbooks Payroll provides services like:

- Direct deposit paychecks

- W-2 Management

- 1099 management

- Automatic tax forms

- Payroll set up

- Payroll support

- Time tracking

Pros and Cons of QuickBooks Payroll

QuickBooks Payroll is one of the leading payroll software solutions. Here are four pros and four cons to consider:

Pros of QuickBooks Payroll:

- Integration with QuickBooks Software: QuickBooks Payroll is seamlessly integrated with QuickBooks accounting software. This means that businesses can manage their finances, accounting, and payroll all in one place, reducing the chances of errors due to data entry between systems.

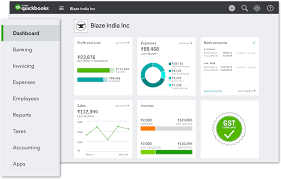

- User-Friendly Interface: The software is designed to be intuitive, with a user-friendly dashboard that makes it easier for businesses to process payroll, calculate taxes, and handle other payroll-related tasks.

- Automatic Tax Calculations and Filings: QuickBooks Payroll offers features that automatically calculate and file federal and state payroll taxes. This minimizes the chances of errors and helps businesses stay compliant.

- Direct Deposit and Mobile Features: The software allows businesses to pay their employees through direct deposit, reducing the need for physical checks. Additionally, QuickBooks offers mobile features, allowing employers and employees to access payroll information on the go.

Cons of QuickBooks Payroll:

- Cost: Compared to other payroll solutions, especially for small businesses with few employees, QuickBooks Payroll can be on the pricier side.

- Limited Customization: Some users find that QuickBooks Payroll doesn’t offer as much customization as they’d like, especially in comparison to some other payroll systems.

- Customer Support: While many users have positive experiences, others have reported long wait times and occasional difficulties getting in touch with the support team.

- Occasional Software Glitches: Like many software products, users have reported occasional glitches and bugs. While updates and patches are often released, these glitches can cause temporary inconveniences.

Quickbooks Payroll Cost

The below are the cost of payroll services currently published on this company’s website as of October 15, 2023.

- Simple Start: $15/month

- Essentials: $30/month

- Plus: $45/month

- Advanced: $100/month

QuickBooks offered several payroll plans, and the cost varied based on the specific features each business needed. Here’s a general overview of the pricing for QuickBooks Payroll at that time:

- QuickBooks Payroll Core: This was the basic plan and included full-service payroll, auto tax filing, and other essential features.

- QuickBooks Payroll Premium: This plan offered everything in the Core plan plus same-day direct deposit, mobile time tracking, and expert setup review, among other features.

- QuickBooks Payroll Elite: The most advanced plan included everything in the Premium plan and added features such as personal HR advisors, custom setup, and protection against tax penalties.

However, please note that the actual pricing can vary based on promotions, location, or changes in offerings by Intuit, the company behind QuickBooks. Additionally, the features included in each plan or even the plan names might change over time.

Find the Right Payroll Program for Your Business

Finding the right payroll service for your business can be overwhelming at times. There are dozens of programs out there that assist with the monstrous task of managing payroll.

Helping you decide if the Quickbooks Payroll cost falls into your budget is our pleasure.

We’ve focused on helping people find the right fit for them by comparing these services for you. If you have questions about which service will serve you best, be sure to contact us at any time.