Rippling Payroll Cost In 2023 | Compare Pros & Cons, Alternatives

Are you an employer and are considering using Rippling payroll? The information here goes over what Rippling is and how much it costs per employee.

Rippling Info:

Headquarters: 55 Second Street. Suite 1500. San Francisco, CA 94105

View PlansRippling is a cloud-based platform that offers a range of HR and IT solutions, with payroll being one of its core services. Here’s a summary in 150 words:

Rippling’s payroll service is designed to be both robust and user-friendly, targeting businesses that seek an integrated approach to human resources and IT management. One of the standout features of Rippling is its automation capabilities: when you hire an employee, it automatically takes care of tasks like adding them to payroll, ordering their equipment, and enrolling them in benefits. The payroll module itself is comprehensive, supporting all types of compensation structures and automating tax filings. Furthermore, its integration capability means it can effortlessly sync with accounting tools, time-tracking systems, and other business software. Beyond just payroll, Rippling offers a centralized platform for managing everything from benefits and onboarding to device management, making it a versatile tool for businesses.

Rippling Solutions

Here are five payroll solutions provided by Rippling:

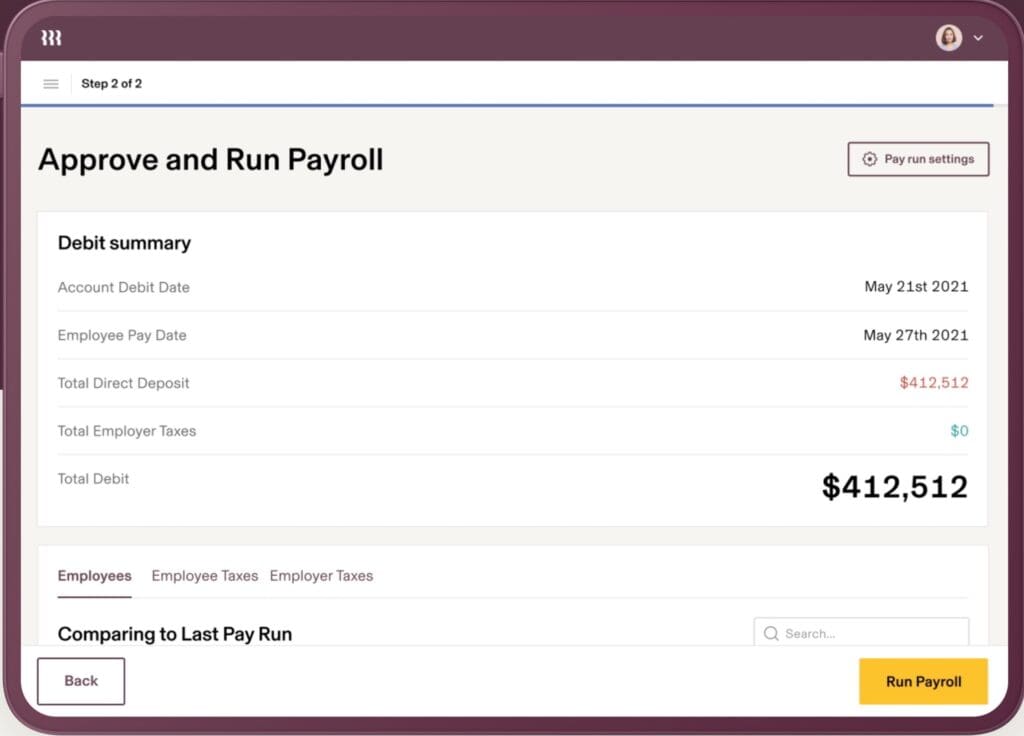

- Automated Payroll: Rippling offers a system that can run payroll automatically, ensuring employees are paid accurately and on time. This automation extends to bonuses, commissions, and other types of compensation.

- Tax Compliance: Rippling takes charge of federal, state, and local payroll tax calculations, filings, and payments. The service ensures that businesses remain compliant with tax regulations and deadlines.

- Integration Capabilities: Rippling’s platform seamlessly integrates with various accounting, time-tracking, and business software. This ensures that payroll data aligns with other parts of the business without manual data entry.

- Benefits Syncing: Any changes in employee benefits, such as health insurance deductions or retirement contributions, are automatically updated in the payroll system, ensuring accurate and up-to-date calculations.

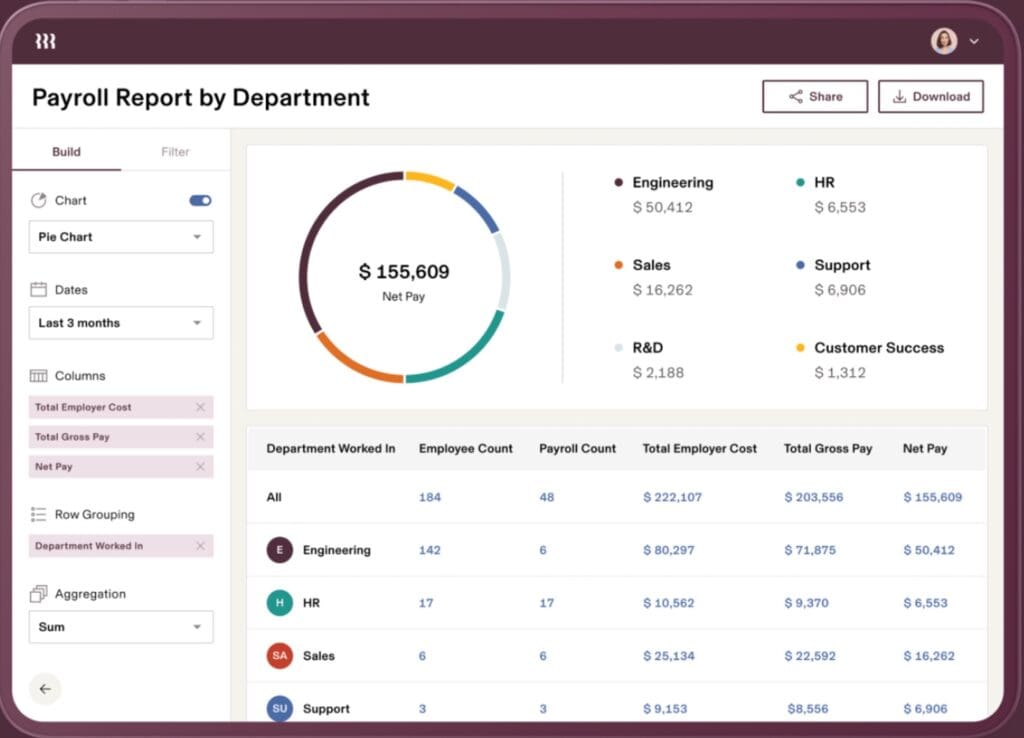

- Detailed Reporting: Rippling provides in-depth payroll reports, giving businesses insights into their payroll expenses, tax breakdowns, and other financial metrics. This aids in better financial planning and forecasting.

These solutions make Rippling a comprehensive tool, aiming to simplify and streamline the complex process of payroll management for businesses.

How Much Does Rippling Payroll Cost For 2 Employees?

COST: Starts at $39/month + $8 PEPM

So the cost for two employees with Rippling would be roughly $55 a month.

Rippling’s pricing for its payroll services was based on a per-employee-per-month model, but the exact cost could vary based on any add-on services or features a company might choose. Given that pricing structures can change over time and might also vary based on promotional offers or bundled services, the best way to obtain an accurate and up-to-date quote for two employees would be to visit the link below or to contact their sales or customer service team directly. They can provide a tailored quote based on your specific needs and the current pricing model.

View PlansHow Much Does Rippling Payroll Cost For 20 Employees?

The cost for Rippling payroll for 20 employees will be $199 a month.

For up-to-date information on how much Rippling payroll cost, use the link below:

View PlansPros and Cons of Rippling Payroll Service?

Rippling’s payroll service is known for its comprehensive features and integrations. However, like any product, it has both advantages and areas that might be seen as limitations for certain users. Here are some pros and cons based on feedback and reviews:

Pros:

- Integration and Automation: Rippling is designed to seamlessly integrate with other HR and IT systems, automating many processes, such as onboarding new hires, which subsequently streamlines payroll setups.

- Comprehensive Platform: Beyond payroll, Rippling offers a suite of HR tools, from benefits administration to device management, making it a centralized platform for various HR needs.

- Tax Compliance: Rippling handles federal, state, and local tax calculations, filings, and payments, reducing the complexity of tax compliance for businesses.

- Benefits Syncing: Changes in employee benefits are automatically reflected in the payroll, ensuring deductions and contributions are always accurate.

- User-friendly Interface: Many users find Rippling’s interface intuitive, which can reduce the learning curve.

Cons:

- Pricing Model: Some small businesses or startups might find the per-employee-per-month pricing model a bit steep, especially when adding other HR tools.

- Feature Overwhelm: Because Rippling offers a multitude of features beyond just payroll, some users might feel overwhelmed by the range of options and settings.

- Integration Limitations: While Rippling offers numerous integrations, it might not connect with every niche software a business uses.

- Learning Curve: Despite its user-friendly interface, the breadth of features means there might be an initial learning curve for users unfamiliar with comprehensive HR platforms.

As always, the best fit will depend on the specific needs and preferences of a business. It’s beneficial to assess both the features offered and the scalability of the solution as the business grows.

Want to examine alternatives? Use the link below and get started today.