What is a Good Credit Score for a Business Loan?

At the very least, you will need a credit score of around 620+ to obtain a small business loan. Are you interested in applying for a business loan? This guide details the ins and outs of what you need to do in order to get a business loan.

You can start or grow your small business with a loan backed by the SBA.

The SBA doesn’t fund small businesses, and you won’t make loan payments to the organization. What the SBA does do is approve lenders to provide funding for SBA-backed loan programs.

By understanding what it takes to prove your creditworthiness to a lender, you can decide if an SBA loan is the right choice for your business. Before you apply for an SBA loan, however, it helps to know what lenders want in terms of your credit score for a business loan.

To find out about applying for a business loan through an SBA-backed lender, keep reading.

What Is an SBA Loan?

Many would-be and current entrepreneurs choose SBA-backed funding to start and grow their businesses. To qualify to make an SBA loan, financial institutions must comply with SBA regulations.

Even though lenders must follow specific guidelines, fees, business loan down payments, interest rates, and business loan requirements may vary from bank to bank. Accordingly, you must speak directly with an SBA approved lender to find out finite details about an SBA loan.

Nevertheless, SBA loans are the most popular financial instrument for small business owners. Entrepreneurs desire SBA loans for several reasons, including:

- Longer terms

- Lower rates

- Reasonable fees

- Small down payments

In addition to funding, the SBA also provides counseling and training through partner organizations like SCORE. By taking advantage of the expertise of SCORE mentors, you can grow your business successfully.

You can apply for more than one kind of SBA loan. Loan types include:

- 504 loans

- 7(a) loans

- 7(a) small loans

- CAPLine

- Community Advantage

- Disaster loans

- Export Express

- Export working capital

- International trade

- Microloans

- SBA Express

The terms and conditions of loans can change at any time. You must speak with a bank representative to learn about the current terms and conditions for each loan type.

If you’re planning to go for an SBA loan, it helps to take the same approach as you would when applying for any other type of loan. First, you’d find out how to qualify for an SBA loan. Then, you’d work toward meeting the requirements.

The same concept applies to secure a loan through an SBA program.

What Is a Term Loan?

A term loan is a loan for a specific amount of money that’s originated from a bank or other institutional lender. Borrowers must comply with a repayment schedule with a fixed or floating interest rate. This kind of loan is appropriate for establishing small businesses.

You may need to make a considerable down payment to secure a term loan. However, this reduces the total cost of the loan and the amount of your monthly payments.

Is There a Minimum Credit Score Needed for an SBA Loan?

As a small business owner, SBA-backing does not guarantee loan approval. A bank lender will review your credit history before you can receive an SBA loan.

There is no SBA loan credit score minimum. The lender, however, will use the bank’s criteria to determine your creditworthiness.

Typically, lenders must only follow two rules to remain eligible to lend SBA funds. They must assess the credit history of borrowers. They must also use reasonable lending standards to make their decisions.

The purpose of SBA loans is to help nurture small businesses. Ultimately, however, you must have decent credit to secure a loan through the program. Out of all the business loan requirements to participate in an SBA program, proving your credit readiness may serve as the most challenging part of the SBA loan process.

No matter where you apply for a small business loan, you will always have to qualify for funding. Often, your credit score is the most important qualifying factor.

How High Must Credit Score be to Get a Business Loan?

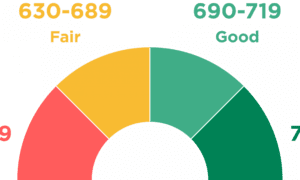

Overall, you want a credit score of 620 to 640 or higher if you’re going to qualify for a small business loan through the program. Still, the exact score needed to qualify for a loan will depend on where you apply and what kind of loan you seek.

For the SBA 7(a) loan, for example, you’ll most likely need a credit score of 680. If you apply for the SBA export assistance loan, you may need a credit score of around 660.

Lenders may decide that you need a credit score of 680 for the SBA 508 loan. If you apply for the SBA CAPLoan, the bank may want you to have a credit score of 660 to qualify for this short-term, working capital loan. If you apply for a microloan, however, you pose less risk as a borrower, so you may only need a credit score of 640 to secure funds.

There are factors, however, besides your credit that lenders evaluate when considering whether to give you a loan. For instance, the banker will assess your ability to repay the loan, should you receive it. To figure this out, they’ll want to see proof of the past performance of your business.

The bank will also want to know if you’re a capable manager. To assess your competency, the banker will want proof that you have professional experience relevant to the business for which you are applying for funding.

Finally, bankers want you to show that you have a vested interest in repaying the loan. To prove this, for example, a banker may want you to show that you have a dollar of cash reserve for every three dollars of the loan amount.

Applying for a Business Loan

Before you can submit an application for an SBA loan, you’ll have a lot of work to do. The first thing that you’d need to do is to gather the necessary documents to apply for the loan.

You’ll need these documents to work within the SBA guidelines. The documentation that you may need to collect includes:

- SBA loan application

- Business certificates and licenses

- Business financial statements

- Business ownership and affiliations

- Business property lease

- Income tax returns (personal and business)

- Loan application history

- One-year profit projection

- Personal background and financial statement

- Profit and loss (P&L) statement

- Resumes of principles

- Statement of personal history

If you’re purchasing an established business, you’ll need to collect additional information. For example, you’ll need the P&L statement for the company as well as two years of tax returns for the business. You’ll also need to secure a Proposed Bill of Sale that includes the terms of the sale.

Are Small Business Loans Hard to Get?

To understand whether it’s hard to secure a small business loan, it’s helpful to review the approval rate of small business applicants in 2019. Large banks, for instance, approved just over 25 percent of small business loan applicants.

Entrepreneurs who applied to small banks for loans, however, fared a little better. Smaller financial institutions approved nearly 50 percent of small business loan applications.

However, alternative lenders are giving both small and large lenders a run for their money. This group of financiers approved nearly 60 percent of all entrepreneurs that applied for small business funding.

SBA-backed loans fell near the middle of the group. Banks approved 54 percent of loans backed by the Small Business Administration.

Small business loan approvals also vary by type. Institutions approved a whopping 82 percent of automotive and equipment loans.

The high approval rate makes sense, as borrowers back these loans with collateral. If a small business can’t make payments, the bank can repossess the equipment and resell it to recoup their losses.

Next, banks approved a significant amount of merchant cash advances. Financial institutions approved nearly 80 percent of these kinds of loans for small businesses.

Banks extended lines of credit to nearly 70 percent of small business applicants. However, they approved only 54 percent of SBA-sponsored loans.

What Are Typical Small Business Loan Terms?

If you need funding for your business, you must weigh your options. You must evaluate the terms of each type of loan that you might secure.

You can repay some loans over just a few months, saving you considerable expenses. Other loans, however, require that you pay in installments over two to three decades.

Improve Your Odds of Getting a Business Loan With Research and Planning

Over time, the cost of borrowing money grows, so you don’t want to borrow more than you need. On the other hand, it’s tough to secure another loan once you have one. So, make sure you borrow enough money the first time if you’re applying for a business loan. Accordingly, you must plan for your needs and research loan terms carefully.

It can prove challenging to find the best loan for your business. Visit the PriceItHere.com loan comparison guide for the latest info on the best small business loans.