How to Know What Your Business is Worth

How do you figure out how much your business is worth? Check out this business market value guide to find out.

Have you wondered how much your business is worth? Are you thinking about selling or getting investors? Do you want to know simple ways to determine what your business is worth?

You are not alone. Based on recent studies, 1 out of 5 businesses are successful in selling their businesses. This is largely due to inaccurate valuation methods.

It’s important to track key performance indicators and how your business is doing regardless of whether you will sell or not. It’s simply great business acumen. At the same time, tracking assets, revenue and profits will help you get a gauge for what your business is worth in case you do decide to sell.

In addition, be aware of the value beyond the financials. This may include the business model, processes, and technology among others.

How do you figure out how much your business is worth? Check out this business market value guide to find out.

Know What Your Business is Worth

You love your business, but you want to sell it. Perhaps, you are ready to retire. Maybe this business wasn’t your legacy and you want to do something different? Either way, you want to know what your business is worth.

You love your business, but you want to sell it. Perhaps, you are ready to retire. Maybe this business wasn’t your legacy and you want to do something different? Either way, you want to know what your business is worth.

You have a general idea of the financial state of your business. However, you want a simple market value guide with a no-nonsense approach.

As a founder, it’s important to know what your business is worth whether you end up selling our not. If you do plan on selling, it’s important to get ready to sell. There will be challenges in selling your business. Make sure you keep the end goal in mind at all times to stay focused.

Why do you want to know what your business is worth? Have you thought about the recent state of your business? Is your business in top shape? Or, do you need to dive deeper into the people, process, and product first? Are there areas in your technology and financials that need cleaning up?

These are a few things to think about before you that will impact the market value of your business worth.

1. Asset Value

To assess your business worth and market value, add up everything the business owns. This includes fixed assets, equipment, and inventory. Once you do this, subtract any debts or liabilities. The balance sheet is a great way to start to assess your market value.

To assess your business worth and market value, add up everything the business owns. This includes fixed assets, equipment, and inventory. Once you do this, subtract any debts or liabilities. The balance sheet is a great way to start to assess your market value.

Don’t let this be your final stop for your business worth. There is a good chance your business is worth much more than your balance sheet. You don’t want to undervalue your market value.

For example, let’s say your total assets equal $1 million and your debt and liabilities are $500,000. This puts you at a market value of $500,000 when you solely use asset value. You’ve got sales too, right? Maybe even profits?

2. Sales Results

Sales results are another part that helps you determine what your business market value is. What were your sales results this year? How about the last 3 years? Are sales growing?

These all factor into the market value of the business. For example, let’s say your sales this year were $2 million with a total of $4 million in the last 3 years. In addition, you’ve experienced growth rates of 10%, 20%, 100%, respectively over the last 3 years.

At a glance, you may see why these steps are important to walk through to determine your business worth. In this example, sales and growth rates are going up so it will positively impact market value. However, if the reverse is true it will impact market value in the negative.

You may see where it starts to be easy to overvalue or undervalue a business. If you were on Shark Tank, there is a good chance Kevin O’Leary would get excited with this example. If you could show that revenue growth will double again into the next year, likely the market value may be $5 million or more.

3. Profit Power

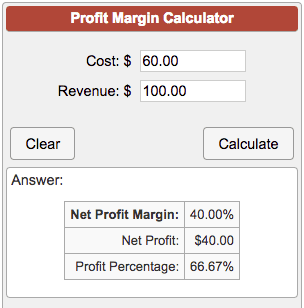

Profit has power. Let’s say your team manages money well. You have master service agreements with vendors that were negotiated well. The sales contracts included operations in discussions, and your margins are over 60%. Cash collection is a breeze with effective management compensation plans that focus on cash.

Profit has power. Let’s say your team manages money well. You have master service agreements with vendors that were negotiated well. The sales contracts included operations in discussions, and your margins are over 60%. Cash collection is a breeze with effective management compensation plans that focus on cash.

As a result, your company is profitable. It is financially healthy. To assess your business worth, an earnings multiple is a great indicator of market value

For example, if a typical P/E ratio is 15 and yours is 20. Using the same example as above, your projected earnings for the upcoming year are $4 million. As a result, the business would be worth $80 million. Being financially sound pays exponentially.

4. Beyond Financials

So far we’ve covered financials on paper. You may have heard the term “Cash is king.” It is incredible to have a financially sound company up to this point. Where many companies fall sometimes is an ineffective cash collection process. If this is the case, and you constantly experience cash droughts, this will impact market value.

Going beyond financials isn’t simply about cash. It’s assessing the value of customers, technology, and marketing to name a few. There are various ways to assess goodwill and intangibles as well to impact your market value.

Perhaps, you are at the early stages of determining your market value. Even if you have already started, go through these steps. You will be glad you did.

Your Business Worth

Determining your business worth and market value isn’t always easy. There may be a lot of areas to assess first. Take the time to not only assess but to improve areas that need attention. In the long run, this will impact your business worth positively.

Follow the steps outlined here from your assets to going beyond the financials. Be diligent in providing the best market value for your business. After all, isn’t it worth it?

There are new things to learn. A chance for you and your team to rise up to the challenge to accurately determine the market value.

What action will you take next to know what your business is worth?

Considering buying a business? Check out these franchise options to learn more.