Credit Card Processing Cost in 2026

Understanding credit card processing is important for businesses dealing with the complex market of payment solutions.

This article looks into the different kinds of credit card processing and the related costs, and the different fees that can impact your bottom line.

Key factors influencing these costs are examined, along with predictions for 2026, including potential increases in fees and shifts toward contactless payments.

Discover practical strategies to reduce processing expenses, ensuring maximum profits in an increasingly digital marketplace.

Top Credit Card Processing Companies and Costs

Stripe Credit Card Processing

- Starting At 2.7% + 5¢

- In-person; 2.9% + 30¢ Online

- Monthly Fee: $0.00

Helcim Payment Processing

- 0.40% + 8¢, plus interchange in-person

- 0.50% + 25¢ plus interchange, online

- Monthly Fee: $0.00

Square Credit Card Processing

- 2.6% + 10¢

- in-person; 2.9% + 30¢ online

- Monthly Fee: $0.00

Chase Merchant Services

- In-person: 2.6% + $0.10

- Online: 2.9% + $0.25

- Monthly Fee: $0.00

Understanding credit card processing is important for businesses dealing with the complex market of payment solutions.

This article looks into the different kinds of credit card processing and the related costs, and the different fees that can impact your bottom line.

Key factors influencing these costs are examined, along with predictions, including potential increases in fees and shifts toward contactless payments.

Discover practical strategies to reduce processing expenses, ensuring maximum profits in an increasingly digital marketplace.

What Is Credit Card Processing?

Credit card processing is an important part of online shopping, helping transactions between customers and stores by utilizing modern payment processing solutions and digital payments. This includes different groups, such as credit card networks like Visa, MasterCard, and American Express, as well as payment gateways and service providers, all working together to make sure payments go through smoothly.

For small business owners, knowing how this works can help manage cash flow, make shopping better for customers, increase sales, and give an edge over competitors in financial technology and the payment processing industry. One of our most insightful case studies demonstrates the importance of selecting the right credit card processor for your business.

What Are the Different Types of Credit Card Processing?

There are different ways to process credit card payments that suit various business needs, such as point of sale (POS) systems, mobile payments, and online transaction methods. Each type has its own unique advantages and can significantly impact transaction volume and operational efficiency. Picking the right credit card processing solution can improve customer loyalty and make the user experience better, which can positively affect your profits.

POS systems work well for physical stores because they make transactions fast and easy at the checkout, lowering wait times and improving customer happiness.

On the other hand, mobile payment options, such as digital wallets and apps, appeal to businesses that need to cater to customers on the go, providing convenience and flexibility.

Online transaction methods are essential for e-commerce businesses, allowing for hassle-free payment processing even during high transaction volumes.

By using these processing methods, businesses can make their operations more efficient, meet customer needs, and increase growth.

What Are the Costs of Credit Card Processing?

Stripe Fees and Pricing

Stripe Fees and Pricing

- Starting At 2.7% + 5¢

- In-person; 2.9% + 30¢ online.

- Monthly Fee: $0.00

Stripe’s credit card processing stands out for its seamless integration and user-friendly interface. Ideal for online businesses, it offers transparent pricing and robust security features. Although it’s more suited for tech-savvy users, its reliability and extensive customization options make it a top choice for e-commerce platforms.

COMPARE Helcim Fees and Pricing

Helcim Fees and Pricing

- 0.40% + 8¢, plus interchange in-person

- 0.50% + 25¢ plus interchange, online

- Monthly Fee: $0.00

Helcim impresses with its transparent, volume-based pricing and no long-term contracts, making it ideal for small to medium-sized businesses. Its all-in-one platform offers robust features like invoicing and inventory management. While its fees can be higher for low-volume merchants, its customer service and reliability are commendable.

COMPARE Square Fees and Pricing

Square Fees and Pricing

- 2.6% + 10¢

- in-person; 2.9% + 30¢ online

- Monthly Fee: $0.00

quare’s credit card processing is renowned for its straightforward pricing and ease of use, catering superbly to small businesses and entrepreneurs. Its free mobile card reader and no monthly fees are highlights, although transaction fees can be high for larger volumes. Its versatility and user-friendly interface make it a popular choice.

COMPAREKnowing how credit card processing fees work is important for businesses to handle their finances effectively. These costs can include processing fees, interchange charges, transaction costs, merchant fees, and other payment processing costs, all of which can greatly impact profit margins.

As a business owner, being aware of these expenses helps you budget and plan your finances, leading to improved cash flow and methods for increasing revenue. Worth exploring: Credit Card Process Cost: What to Expect for potential cost-saving strategies.

What Are the Different Fees Involved in Credit Card Processing?

Credit card processing fees come in various forms, each impacting your bottom line in different ways. Common fees include interchange fees, cardholder fees, chargebacks, and foreign transaction fees, all of which can accumulate and affect your operational expenses. Knowing how these fees work is important for managing costs and running your business smoothly.

Each type increases the total cost of acceptance and can make your accounting processes more difficult.

For example, interchange fees are typically paid to the bank that issued the card, while chargebacks arise when a customer disputes a transaction, leading to potential financial loss and additional penalties.

Foreign transaction fees, on the other hand, can be particularly burdensome for businesses dealing with international clients, as they often result in unexpected costs that can quickly add up.

Business owners can plan well by learning how these fees operate and influence their profits, which helps to lessen their effect and grow earnings.

Compare Credit Card Processing – Start Below

How Do Credit Card Processing Costs Vary by Payment Processor?

The costs of credit card processing can vary significantly depending on the payment processor you choose, with each offering different pricing strategies and fee structures. By comparing different financial services, you can find which processor fits your business needs and budget the best. Knowing these differences can help you make better decisions and run your operations more smoothly.

Factors influencing the costs include the processor’s transaction volume, type of transactions (in-person or online), and risk assessment policies. Many providers have pricing models like tiered, flat-rate, or interchange-plus. This can make choosing the right one confusing.

Businesses can find extra costs like chargebacks or monthly minimums that might impact total spending by looking at competitor pricing and services. Negotiating rates based on projected sales volumes or long-term contracts can yield significant savings, enhancing the company’s financial health in the long run.

What Are the Factors That Affect Credit Card Processing Costs?

Many things can affect credit card processing costs, so businesses need to know about these factors to control expenses well.

Important aspects include:

- The number of transactions and transaction speed

- The type of business and payment methods used

- Operational costs and merchant services expenses

- Risk assessment methods and fraud prevention strategies

Knowing about these financial factors and employing cost reduction strategies helps businesses change their strategies to make payment processing better and increase profits. As mentioned in our guide to credit card processing costs, understanding these elements is crucial for forecasting expenses effectively.

1. Type of Business

The type of business you operate plays a significant role in determining your credit card processing costs, as different industries have varying standards, expectations, and compliance requirements. For instance, eCommerce businesses may experience different fee structures and cost structures compared to brick-and-mortar stores.

Service-based companies, such as salons or repair shops, often face unique challenges as they may rely heavily on in-person transactions, whereas subscription-based services might benefit from lower transaction fees due to predictable billing cycles.

Each change in the business model can impact processing rates and also influence how satisfied and loyal customers are. For example, a retailer with high processing fees might have to pass these costs onto customers, potentially impacting overall sales and customer retention.

Knowing the exact processing costs for various businesses helps make better choices that can result in smoother operations and a better experience for customers.

2. Volume of Transactions

Transaction volume is another critical factor that impacts credit card processing costs, with higher volumes often leading to reduced processing fees. Learning how the number of transactions affects your total costs can help you create good revenue plans and stay aware of cost changes. Businesses can use this knowledge to improve their processing abilities and increase profits.

When businesses handle a large number of transactions, they get lower fees and can create better connections with payment processors, which might lead to improved terms and rewards.

Knowing how the number of transactions impacts processing fees allows organizations to estimate their costs and manage resources well. This strategic awareness allows them to implement revenue models that maximize income while minimizing unnecessary overhead.

Adjusting to changing cost patterns helps businesses remain competitive, allowing them to expand operations without hurting their profit margins.

3. Type of Payment Method

The type of payment method used by customers can affect credit card processing costs, as different methods come with distinct fee structures. For example, mobile payments may incur different fees compared to traditional credit card transactions. Knowing these differences helps businesses improve their transaction processes and make customers happier.

Businesses need to be aware that various credit card types, such as rewards cards or corporate cards, often carry higher processing fees and interchange fees due to their benefits. Choosing the right payment option can lower expenses and make the checkout process easier for customers.

By effectively managing these payment options, businesses can better control their operational expenses while simultaneously catering to the preferences of their clientele.

This approach leads to customers coming back more often and buying more, proving that choosing payment options involves more than just looking at fees.

4. Type of Card Used

The specific type of card used by customers can also influence credit card processing costs, with certain credit card networks setting higher interchange fees for premium cards. Knowing the impact of this can help businesses handle their costs while providing smooth service to customers. Knowing which cards your business accepts can help keep customers coming back.

Businesses must choose from various credit card options, such as rewards cards and corporate cards, each with its own fees.

To effectively manage these differences, companies should regularly review their payment processing agreements and consider adopting strategies such as tiered pricing or offering discounts for specific card types.

By learning about interchange fees and the impact of different credit card networks, businesses can improve how they accept payments, leading to happier customers and better financial outcomes.

What Are the Predictions for Credit Card Processing Costs ?

Some trends might affect the costs linked to credit card processing, giving businesses an idea of what to expect.

Experts predict that interchange fees will go up because fraud prevention is becoming more complicated, impacting annual percentage rate and payment security. Businesses should recognize these changes, improve security measures, and modify their payment methods for more accurate cost analysis and risk management.

Understanding financial trends can help you handle changes in payment systems by adding payment processing rules and using new technology like artificial intelligence to improve fraud detection and customer service. Related insight: Implementing advanced point of sale systems can further streamline operations and enhance security.

Credit Card Processing Fees: A Study of Visa, MasterCard, and American Express and How Consumer Credit and Online Shopping Affect the Competition and Market Review.

COMPARE

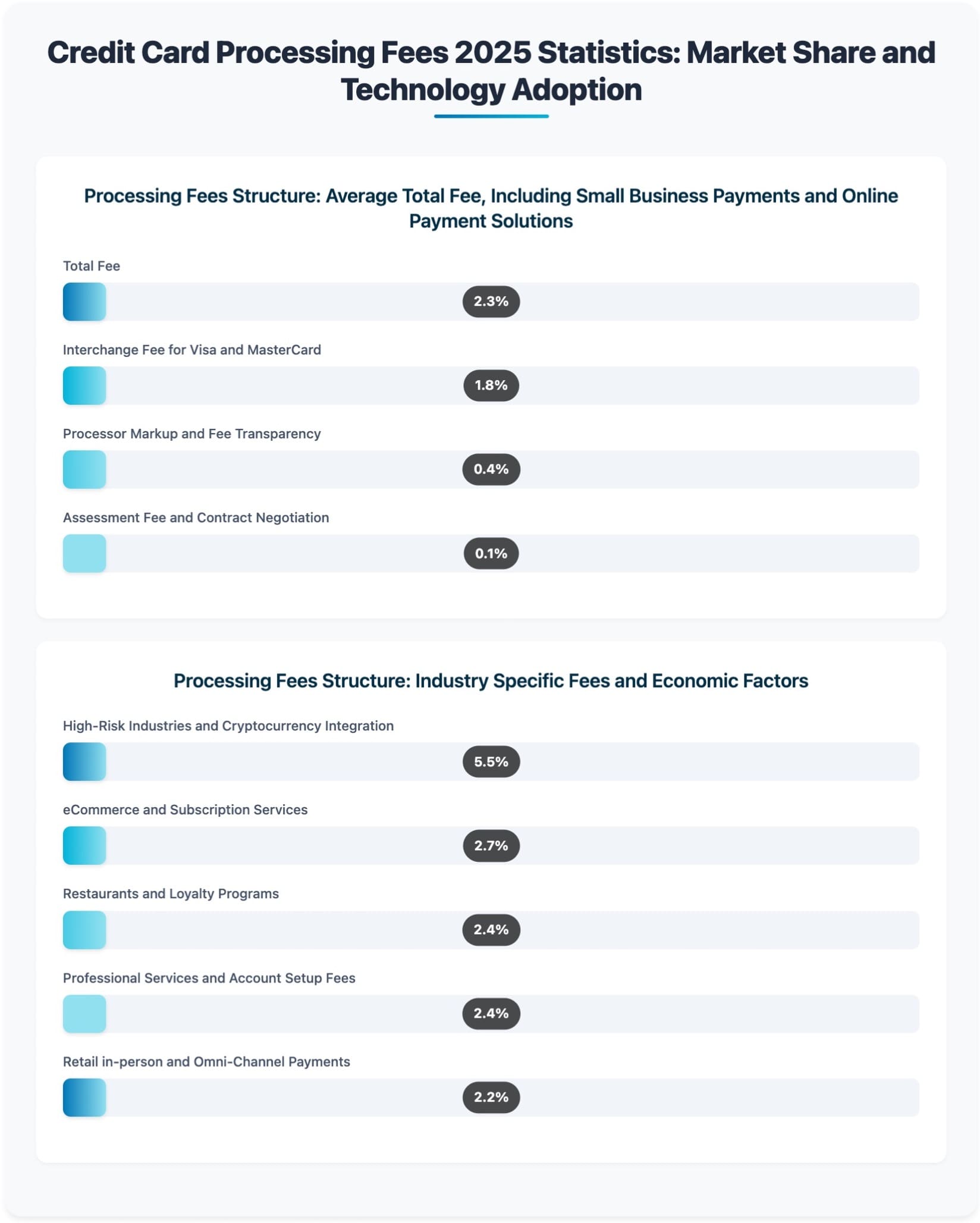

The Credit Card Processing Fee Statistics Information shows the cost details of processing credit card payments, focusing on typical fees and those specific to different industries. This information is important for businesses to know their cost responsibilities when they take credit card payments, which affects their pricing plans and profit levels.

Processing Fees Structure includes several parts that make up the complete fee of 2.34% on transactions. The Interchange Fee, charged by the cardholder’s bank, is the largest component at 1.8%. This fee compensates for the risk and handling of transactions. The Assessment Fee of 0.14% is charged by card networks (e.g., Visa, MasterCard) to keep network functions running. The Processor Markup, at 0.4%, is the amount charged by the payment processor for facilitating the transaction. These parts make up the complete fee structure that businesses deal with when handling payments.

Understanding Industry Specific Fees is critical for businesses within distinct sectors as they face varied costs. For Retail in-person transactions, the fee is 2.225%, benefiting from lower risk associated with card-present transactions. eCommerce businesses, however, face increased costs at 2.7% due to increased fraud risk and the costs of online security measures. The fee for Restaurants and Professional Services is 2.35%, reflecting moderate risk levels. High-Risk Industries, such as travel or gambling, incur the highest fees at 5.5%, due to greater chargeback and fraud risks.

These statistics illustrate that businesses must consider their industry’s specific fee structure in financial planning. When companies know about processing fees, they can choose better payment methods, adjust prices, and improve customer service to reduce costs and increase earnings.

1. Increase in Interchange Fees

A significant trend expected to continue is the rise in interchange fees, which will directly raise processing costs for businesses. As these fees rise, effective financial planning and cost management strategies become essential for maintaining profit margins and ensuring business scalability. Adjusting to these changes can improve how your business runs and how customers feel about your service.

Businesses need to stay proactive by evaluating their payment processing systems and exploring alternative payment methods like digital wallets that could mitigate the effects of these rising costs.

Negotiating better terms with payment processors and adopting more efficient technologies can help in reducing fees. Knowing how interchange rates work helps businesses predict expenses and plan their budgets effectively.

By using this information in their financial planning, companies can handle the challenges of rising costs and build a strong financial system to support growth over the long term.

2. Rise in Fraud-Related Fees

The expected rise in fraud-related fees is another factor businesses must consider as they prepare for 2026, as companies become increasingly focused on payment security. Putting solid risk management strategies in place can reduce the effects of these fees, keep up with changing rules, and maintain customer trust. Staying ahead of these challenges is key to long-term success.

As the way we handle financial transactions changes, organizations face the challenges of increasing operational expenses and more attention from regulatory authorities.

This requires actively creating thorough compliance plans that use modern technology and data analysis to improve payment security systems.

Encouraging employees to be aware is important because knowledgeable staff can more easily identify and report suspicious actions.

By focusing on these actions, businesses can handle upcoming cost rises and strengthen their reputation in a market that is becoming more competitive.

3. Shift Towards Contactless Payments

The shift towards contactless payments is expected to gain momentum, influencing both customer preferences and processing costs. As businesses start using this new payment method, knowing how it affects transaction processes and customer experience will be important for staying competitive in the market. Keeping up with technology trends can improve how your business runs and make your customers happier.

With the increased demand for quicker, more efficient transactions, customers are embracing the convenience that contactless payments offer. This increasing choice makes buying easier and faster, leading to higher customer satisfaction.

Businesses must also consider the potential impact on credit card processing costs, as the integration of advanced payment technologies may require initial investments and ongoing updates. By using these new technologies, companies can reduce operational problems and create a stronger relationship with their customers, building brand loyalty and enhancing the overall customer experience.

How Can Businesses Reduce Credit Card Processing Costs?

Lowering the fees for credit card transactions is something many companies want to do, and there are ways to make this happen.

By talking with payment service providers, using ways to cut costs, and looking at flat-rate pricing, companies can manage their spending well while staying competitive. For instance, choosing the right credit card processor can be crucial- simplifying your transactions can significantly impact cost management.

Being proactive can improve cash flow management and make budget planning more accurate.

1. Negotiate with Payment Processors

One of the most effective ways to reduce credit card processing costs is to negotiate with payment processors, as many are open to discussions about pricing strategies and service level agreements.

Knowing the details of their fees is important because it helps business owners find opportunities to negotiate better terms.

When diving into competitive analysis, one should gather data on what similar industries are paying and use this information as a bargaining chip. This means being prepared to share results and explain how lower rates help with current cash flow and support lasting business relationships.

Using effective negotiation techniques, such as highlighting transaction sizes or customer commitment, can increase the likelihood of securing more favorable contract terms.

2. Implement Cost-Saving Measures

Implementing cost-saving measures is essential for businesses looking to minimize credit card processing expenses while maximizing operational efficiency. These steps can involve improving payment methods, lowering transaction limits, and examining your payment system for any inefficiencies.

By focusing on budget considerations, forecasting, and sound financial planning, businesses can significantly improve their overall expense management.

Looking into different payment processors can help businesses find better fee arrangements, letting them match their payment plans with their financial objectives.

Training staff on best practices for payment processing and PCI compliance can help reduce errors and speed up transactions, further enhancing efficiency.

Regularly checking processing statements can reveal hidden fees, helping you make better decisions about vendor contracts.

Using technology like automated invoicing can make tasks faster and reduce the time spent on doing them by hand, freeing up resources for other important parts of the business.

3. Opt for Flat-Rate Pricing

Choosing flat-rate pricing can make credit card processing costs simpler, helping businesses to handle their expenses more easily and clearly. This structure allows businesses to easily forecast expenses based on transaction volume, ensuring better cost management. Learning about the advantages and disadvantages of flat-rate pricing helps you decide on your payment processing plan.

While flat-rate pricing does offer predictability and clarity, it may not always be the most cost-effective option for businesses with varying transaction sizes.

Large-ticket transactions, for instance, can lead to higher fees compared to tiered pricing models, where costs can fluctuate based on the type of card used. Some may find that flat-rate structures lack the flexibility needed to accommodate changing business needs.

By comparing different pricing models, one can ascertain whether flat-rate pricing aligns with their specific operational requirements while also keeping an eye on overall transaction limits and processing costs.

4. Consider Alternative Payment Methods

Considering alternative payment methods, such as digital wallets, can provide businesses with cost-saving opportunities while enhancing the customer experience. These payment options usually have reduced fees and can make transactions faster, which makes them appealing as payment methods change.

Keeping up-to-date with cost changes for different payment options is important for staying competitive.

Using digital wallets makes paying at the checkout easier for customers and encourages them to return by providing smooth payment options.

Businesses that adopt these technologies may also notice a reduction in cart abandonment rates, as customers appreciate the speed and convenience of quick transactions.

As customers look for safer and faster ways to pay, knowing the details of these options can help businesses meet their customers’ needs, leading to higher sales and protecting profits.

COMPARE

Compare Local Credit Card Processors & Get Up to 5 Money-Saving Quotes

People That Viewed This Page Also Found These Pages Helpful:

Stripe Fees and Pricing

Stripe Fees and Pricing Helcim Fees and Pricing

Helcim Fees and Pricing Square Fees and Pricing

Square Fees and Pricing