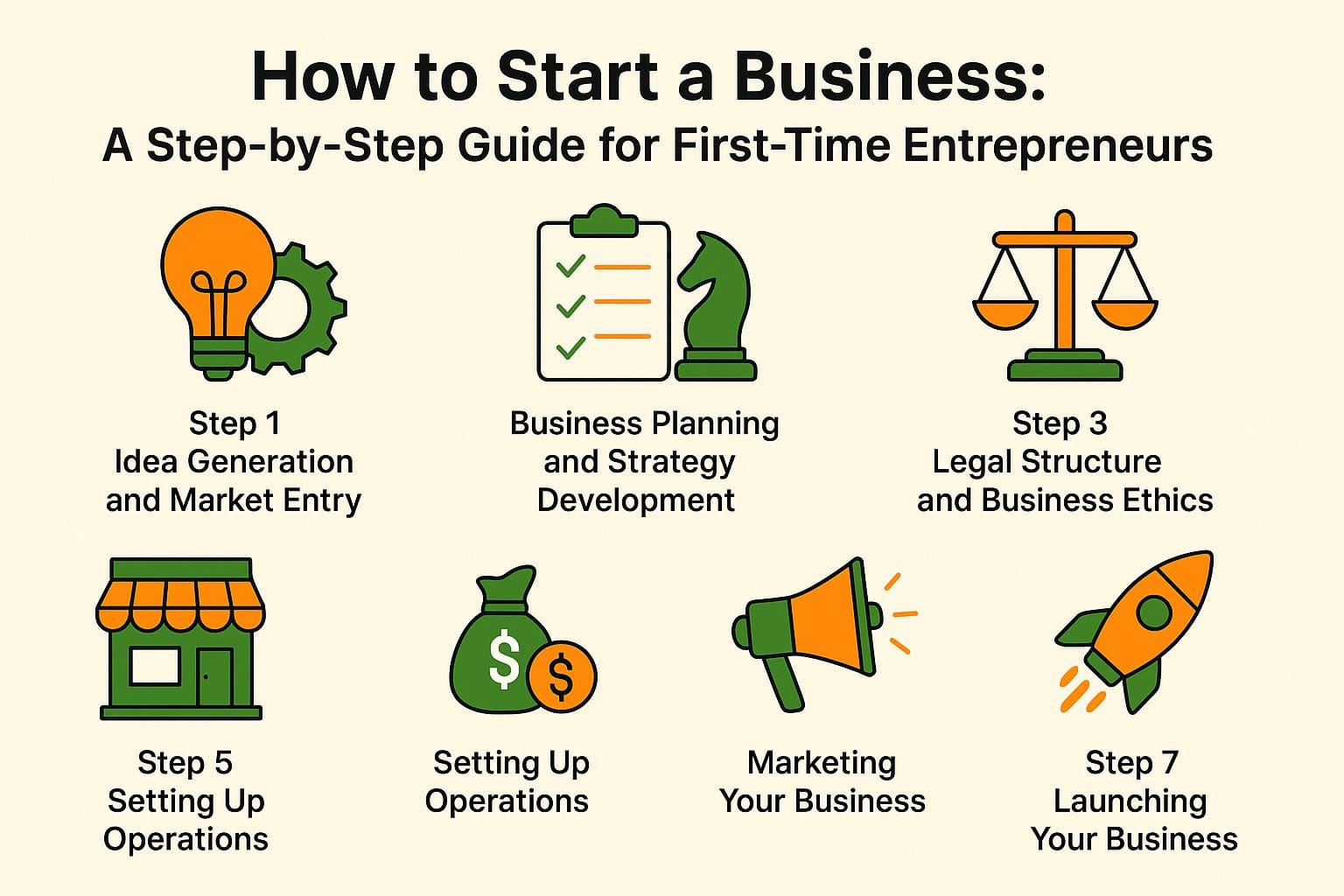

How to Start a Business: A Step-by-Step Guide for First-Time Entrepreneurs

Beginning a business can be both exciting and challenging, particularly when thinking about things like branding and how the business will operate. You have a vision, but where do you begin? Knowing the basics of entrepreneurship, operations, and business management is essential for making your idea a success. This guide walks you through each key step, from brainstorming ideas and creating a solid business plan to learning about legal structures such as LLCs and sole proprietorships, and launching your business. Ready to take the plunge? Let’s look at how you can turn your dreams into a successful business.

Understanding Entrepreneurship

Starting a business means finding chances, handling risks, and using resources to build something useful.

Successful business owners show traits like resilience and flexibility, enabling them to manage risk and handle obstacles effectively.

Resilience allows people to recover from setbacks; for example, J.K. Rowling dealt with many rejections before getting a publisher for Harry Potter.

Being flexible is just as important; business owners need to change direction when the market shifts, like how Netflix moved from renting DVDs to offering streaming services.

By developing these skills, aspiring entrepreneurs can increase their chances for success, while staying flexible in a business world that is always changing.

Why Start a Business and Develop an Entrepreneurial Mindset?

Starting a business can offer personal fulfillment, financial independence, and the chance to innovate in your field.

Financially, small businesses account for 44% of U.S. economic activity, providing lucrative opportunities for business growth and investment. By 2022, statistics indicated that entrepreneurs could earn an average income of $83,000 annually, which may be significantly higher than traditional employment in some fields.

Starting a business helps you grow as a person by teaching you new skills and handling challenges, making you stronger and more adaptable. Small businesses play an essential role in creating jobs, adding about 1.5 million new positions each year. This helps improve the local economy and provides work opportunities for people.

Step 1: Idea Generation and Market Entry

Creating a practical business idea is a key initial step in starting a business, ensuring it aligns with market demand.

Identifying Your Passion for Customer Acquisition

Finding what you love can greatly improve your chances of business success, giving you more drive and strength.

Start by engaging in self-reflection exercises, such as journaling your interests and experiences. Take 10-15 minutes daily to jot down things that make you feel lively.

Use MindMeister, a mind mapping tool, to visually arrange your ideas and find links between your interests. Look into online platforms such as Coursera or Skillshare for classes in areas that interest you.

Share what you learned with friends or mentors you trust. Their thoughts can help you understand your interests and show you clear steps to take.

Market Research Techniques

Doing detailed market research helps confirm your business idea and learn about what your target audience wants and likes, aiding in effective branding and marketing strategy.

To gather useful information, use surveys, study competitors, and organize focus groups.

For surveys, Google Forms is an excellent tool-create targeted questions that assess preferences and pain points.

SEMrush makes competitor analysis easier by helping you find their keywords, marketing strategies, and competition analysis.

Organize focus groups to gather qualitative feedback; invite a small group of potential customers and record their responses to your product concepts.

Gathering information from different sources can give you a complete view of your market.

Evaluating Business Ideas

Evaluating your business ideas through feasibility studies and SWOT analysis can provide clarity on potential success.

- Begin by creating a SWOT analysis template in Google Docs: list Strengths, Weaknesses, Opportunities, and Threats in separate sections.

- Bring important team members together to share ideas and get different viewpoints.

- For scoring techniques, assign numerical values to ideas based on criteria such as market demand, competitive advantage, and resources required.

- After scoring, visualize the results in a simple chart to compare ideas side by side.

- This organized method helps to determine if each idea is practical and involves your team in assessing them.

Step 2: Business Planning and Strategy Development

A detailed business plan outlines your business goals, approach, and financial forecasts. For those looking to expand their operational capabilities, integrating technological solutions can be crucial. Explore our step-by-step guide to choosing the right POS system that aligns with your industry needs for enhanced efficiency.

Creating a Business Plan and Revenue Streams

Utilizing tools like LivePlan can simplify the business plan creation process, providing templates and guidance for strategic partnerships and business continuity.

To create a complete business plan, begin with an Executive Summary that explains your business idea and objectives.

Next, analyze the market to find out who your audience is and who your competitors are.

A detailed Organization and Management section follows, explaining your business structure and team. Add a Product Line section that explains what you sell and how customers can benefit from it.

Develop a Financial Projections section to forecast revenue and expenses.

Tools like Bizplan and Enloop can make this task simpler by providing step-by-step help and features for easy teamwork.

Setting Business Goals and Objectives

Creating goals that are Specific, Measurable, Achievable, Relevant, and Time-bound helps your business stay clear and focused.

A clear goal for a new business could be: ‘Increase the number of visitors to the website by 30% over the next three months by writing a blog post each week and sharing it on social media.’

To track this progress effectively, consider using Trello, where you can create lists for each goal, assign tasks, and set deadlines.

Google Analytics provides the necessary metrics to measure traffic changes, allowing for data-driven adjustments throughout the quarter.

Financial Projections and Cash Flow Management

Accurate financial forecasts are essential for securing funding, venture capital, and evaluating your startup’s financial health.

To create financial projections, start by developing a sales forecast using tools like CRM based on market research and historical data.

For example, use Excel to create a simple sales model that estimates monthly revenue based on anticipated units sold and pricing strategy.

Next, outline your expense budget, including fixed costs like rent and variable costs such as marketing.

Calculate how long it will take for your startup to start making a profit. This involves comparing total sales against total costs, allowing you to adjust your business strategies accordingly.

This structured approach can significantly improve your financial readiness.

Step 3: Legal Structure and Business Ethics

Selecting the correct legal setup for your company affects taxes, responsibility, and how you can operate.

Choosing a Business Entity and Exit Strategy

Knowing the differences between LLCs, corporations, and sole proprietorships helps you choose the right option.

Each entity type offers distinct advantages and challenges. Sole proprietorships are the simplest and least expensive to establish, but they expose personal assets to liability.

LLCs, while slightly more complex, provide limited liability protection and flexible taxation options. Corporations, on the other hand, offer strong liability protection and can raise capital through stock issuance, but entail more regulatory requirements and higher incorporation costs.

Assess your business’s risk profile, tax implications, and funding needs to choose the right structure that aligns with your long-term goals.

Registering Your Business

Registering your business involves specific steps and legal considerations, often requiring a registration fee of $50-$300 depending on your location.

- To successfully register your business, start by determining your business structure, such as sole proprietorship, LLC, or corporation. This will dictate the forms you’ll need.

- Next, gather essential documents, including your identification, tax identification number, and any necessary licenses specific to your industry. Research state-specific requirements on sites like the U.S. Small Business Administration (SBA) or your state’s Secretary of State website.

- Expect to pay filing fees and potentially annual reports. For example, a California LLC might have a $70 filing fee, while in Texas it could be around $300.

Step 4: Financing Your Business and Exploring Funding Options

Knowing your startup costs is important for managing finances and planning your budget, helping you face early expenses.

Startup Costs and Budgeting

Startup costs can range from a few hundred to tens of thousands of dollars, depending on your business model, industry, and market trends.

To effectively budget for these costs, categorize your expenses into three groups:

- Fixed costs (e.g., rent, utility bills)

- Variable costs (e.g., inventory, marketing)

- One-time costs (e.g., equipment purchase, business licenses)

A Google Sheets template can help track these categories. Create columns for each expense type, projected costs, and actual costs, updating it monthly. This way, you’ll clearly see how your expenses align with your budget, allowing you to make informed financial decisions as your business evolves.

Funding Options Available: Grants, Crowdfunding, and Angel Investors

Diverse funding options, such as bootstrapping, angel investors, and crowdfunding, can help you finance your business effectively.

Bootstrapping involves using your personal savings to fund the startup. While this keeps you debt-free, it may limit growth potential.

Angel investors, like those on platforms such as AngelList, can provide significant capital in exchange for equity, offering mentorship alongside funds.

Crowdfunding platforms like Kickstarter enable you to raise small amounts from many backers, a strategy often used by startups in incubators or accelerators. This method offers funding and confirms that your product idea works in the market.

Each option has its trade-offs, so assess your business needs, growth goals, and risk tolerance before deciding.

Step 5: Setting Up Operations

For your business to run smoothly, you need reliable technology and effective time management. It affects how happy your customers are and how much money you make.

Choosing a Location

The choice of location can impact your business’s accessibility, costs, and overall success, often factoring in a budget of $1,000-$10,000 for initial setup, especially for brick-and-mortar stores.

Start making your decision by figuring out how close your target market is and doing a SWOT analysis. Use Google Maps to analyze demographic data, ensuring your location aligns with where your customers are.

Next, assess logistics by considering transportation options for both your clients and suppliers, which can affect delivery times and inventory management.

Use tools like Yelp or industry-specific directories to check if there are already businesses nearby. This will help you see if you will have strong competition or a unique chance in the market.

Creating an Online Presence

Building a strong online presence involves setting aside $500-$2,000 for a website and using social media platforms.

Begin by choosing a platform like WordPress for flexibility or Wix for user-friendliness, allowing you to build a professional-looking site without extensive coding.

Allocate budget for domain registration ($10-$20/year) and hosting ($100-$300/year), which are essential steps in website development.

Next, create profiles on prominent social media platforms such as Facebook, Instagram, and LinkedIn, tailoring content to suit each audience.

Regularly post engaging content, use tools like Hootsuite for scheduling, and interact with your audience to build community.

This method increases your website’s visibility and attracts more visitors.

Step 6: Marketing Your Business

A successful marketing plan, incorporating digital marketing and SEO, can expand your reach and increase customer interaction, resulting in more sales.

Developing a Marketing Strategy

Creating a detailed marketing plan includes studying your target audience, analyzing consumer behavior, and setting clear goals that can be measured.

Start by using tools like HubSpot or Google Analytics to collect information about user age, gender, location, and how users interact with your site. Identify key segments based on factors such as age, location, and interests.

Next, clearly state your goals. For example, try to increase website traffic by 20% in six months or improve social media interaction by 15%.

Make content specific to each group of your audience, using A/B testing to improve your methods. Regularly check and change your approach based on performance data to make sure things keep getting better.

Utilizing Social Media

Using social media can increase how well people see and interact with your brand, enhancing your online presence and personal branding. 73% of marketers say it has worked well for their business.

To maximize your social media impact, choose platforms that align with your target audience. For example, Instagram is ideal for lifestyle brands, while LinkedIn suits B2B companies.

Create engaging content using tools like Canva for visuals and Buffer for scheduling, key components of an effective sales strategy. It’s important to assess success using analytics tools like Hootsuite. This tool monitors interaction and gives detailed information on how posts are doing.

Regularly review these metrics to adjust your strategy, ensuring your content resonates with your audience and achieves the desired engagement.

Step 7: Launching Your Business

Organizing a launch event can create interest and inform the community about your new business, serving as a key part of your launch strategy.

Planning the Launch Event

A well-structured launch event should have a budget ranging from $500 to $5,000, depending on the scale of the celebration.

- Begin by selecting a venue that aligns with your brand image and business networking goals, whether it’s a trendy co-working space for startups or a formal conference hall for corporate launches.

- After you have the place set, concentrate on details: set up food services, sound and video systems, and seating for a hassle-free event.

- After the event, send each attendee an email that thanks them for coming and includes a survey for their feedback.

- Tools like Eventbrite help in handling registrations and sending follow-ups quickly, improving your event plan.

Before the grand opening, make sure all your backend systems are in place — especially payroll. Even if you’re not hiring right away, setting up a payroll service in advance ensures you’re ready the moment you bring on your first employee.

👉 Compare online payroll costs here to find the best service for your business and avoid last-minute headaches.

With the right planning and tools, your business will be set up for a smooth and successful launch.

About The Author

Jordan Blake is a B2B strategist and contributor at Price It Here, where she shares expert advice on buying decisions and business growth. She holds a Bachelor’s in Business Administration from the University of Michigan and an MBA from Northwestern’s Kellogg School of Management.

With over a decade of experience in procurement and vendor strategy, Jordan helps businesses save money and scale smarter. Her practical insights make her a trusted voice for entrepreneurs seeking cost-effective, results-driven solutions.