How To Protect Personal Finances From Risky Business Operations

When you start a company, there are implications that can affect your personal finances and legal situation. With these pointers, you can insulate yourself from any issues that your business may encounter in the future.

Obviously, when starting a new business venture, no one plans on having things go wrong. However, statistics show that the vast majority of new businesses fail. When someone pours their expertise and time into creating a new business, they often are also funding the start-up with their own resources. However, in the event of a failure, you need to consider what repercussions there could be for you personally, outside of the failure of your new business.

You don’t have to make yourself vulnerable in this fashion. There are ways to protect yourself so that in the event that of a business failure, your own resources are safe. Using these techniques allows entrepreneurs to continue to seek the winning formula for a business by protecting their own resources. Then, if a business fails, they still have the ability to get back on their feet and approach their next venture.

If you’re considering going into business for yourself, especially if it is for the first time, consider these tips for protecting your wealth from any risks that your business might have to take.

Implement Sound Business Practices

This should go without saying, but it is critical that you keep everything aboveboard and within the rules when operating your business. If you are negligent or act in a way that you could be held liable for, it can put both your company and you at risk.

Careful documentation is an essential part of being able to prove that your company always acts above board. Even companies who do everything right are sometimes accused of negligence, and having a paper trail demonstrating your business ethics is an immensely valuable tool in the event that this should happen to you. The particulars of the best way to document your processes and procedures to prevent liability in this fashion will depend on your industry, and consulting with a legal expert with experience in your field is the best way to ensure that you’re protected.

Draw a Line Between Your Company and Yourself

From day one, you should take steps to ensure that your money and that used by your business are kept, tracked, and managed separately. With a small operation it often appears easier to simply use your personal finances to fund the business and not worry about this step, or to move money back and forth without a thought to the consequences. However, this muddies the waters and can create tax implications for you that you’ are not expecting down the road. Should your business experience financial trouble in the future, this type of intermingling means that your personal assets will be at risk.

From day one, you should take steps to ensure that your money and that used by your business are kept, tracked, and managed separately. With a small operation it often appears easier to simply use your personal finances to fund the business and not worry about this step, or to move money back and forth without a thought to the consequences. However, this muddies the waters and can create tax implications for you that you’ are not expecting down the road. Should your business experience financial trouble in the future, this type of intermingling means that your personal assets will be at risk.

A common theme here is documentation. In addition to keeping your finances for personal and business matters separate, you should keep separate, detailed documentation showing how money flows in and out of both your personal and business accounts. The more detailed you can be, the easier it is to prove in the future that you and your business are separate legal entities. Once a year, have a financial professional review your business finances and your personal banking information to ensure that the lines of clarity between the two are being maintained properly.

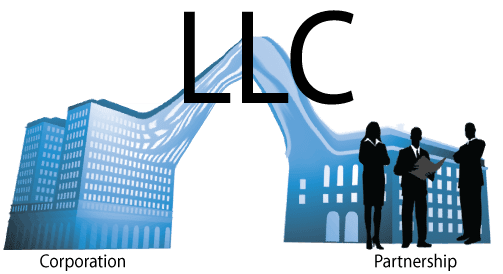

Create a Legal Entity

When you run a business as a sole proprietor, as many entrepreneurs do, there is no legal distinction between you and your company. This means that the risks the company takes are your risks, even if you have taken some minimal steps to try and separate the two.

When you run a business as a sole proprietor, as many entrepreneurs do, there is no legal distinction between you and your company. This means that the risks the company takes are your risks, even if you have taken some minimal steps to try and separate the two.

The best way to do this is to form an LLC, or limited liability company, in order to create a distinct legal entity for your business. There are other organizational structures that can also be used in such a case, but an LLC is one of the most common. This creates a separate financial and legal body that will be responsible for the financial and legal responsibilities of the company. This offers separation between you and your business – however, as the primary shareholder or owner of the business it does not grant you blanket permission to make mistakes. This is not a get out of jail free card, but rather some legal distance between you and your company that will protect you in the event of unavoidable issues, such as a lawsuit against your company.

Insurance is Vital

Speak to an insurance professional about how to protect your individual assets and those of your company through separate policies. The specifics of this are far beyond the depth of this article, as the suitable insurance will depend on what industry you operate in, the kind of assets you possess, and the operational specifics of your company.

Regardless, insurance is a vital piece of the protective puzzle. With it, should you encounter any business liability you can ensure that you have a policy in place in order to deal with the fallout from legal issues your company might run into. Ultimately, no one can predict every type of wrongdoing or negligence that can arise within a business operation. Insurance can provide protection for when the unthinkable finally happens.

Keep Looking for Separation

Ultimately, these tips are just a starting point for insulating your resources from any risks faced by your business. Continue to consult with your financial and legal professionals in order to find further ways to separate the two. There are key points to always keep in mind however:

- Keep finances separate when possible

- Insure your business to protect yourself from liability

- Create a separate entity for corporate operations

- Create policies and procedures for ethical, safe, and legal operations

If you follow these guidelines while continuing to seek further ways to separate your assets and your company, you will be well protected in the unfortunate event that something should go wrong in the future.

Related Articles: